Risks vs Benefits

There are different approaches to this. Therefore, we summarized the basics about this issue for you:

Absolute vs. Comparative Advantage

Absolute advantage describes a scenario in which one entity can manufacture a product at a higher quality & efficiency, and a faster rate than any other competing company, in isolation of all other factors. An absolute advantage, or disadvantage, in a particular industry can play a critical role in deciding which goods to sell and/or produce.

Comparative advantage takes into consideration the Opportunity Costs (OC) involved when selecting goods with limited resources. Opportunity costs represent the benefits an investor or business owner misses out on when choosing one alternative over another:

OC = Return on best foregone option – Return on chosen option

Companies should specialize in the goods they can produce most cost-effective, and trade them for those goods they cannot. This is where the real benefits of international trade come into play.

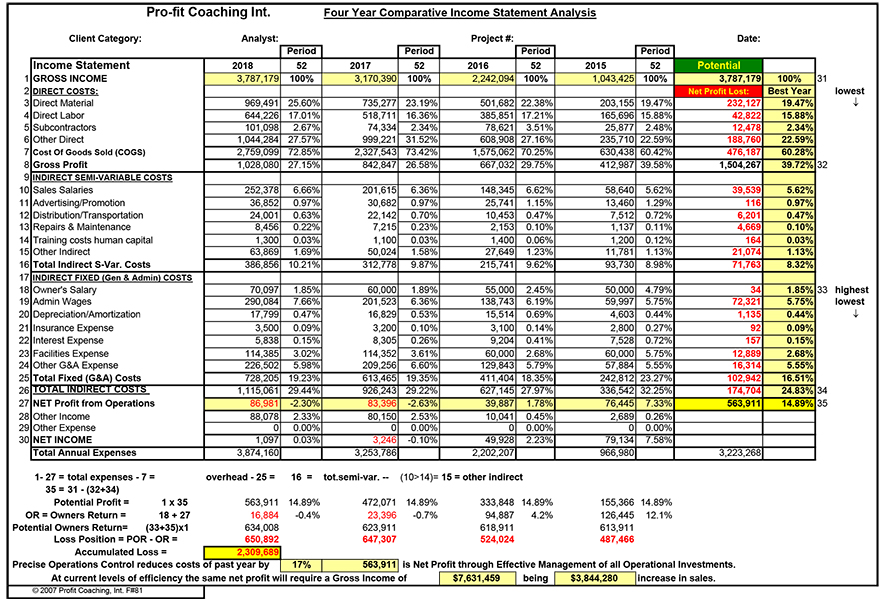

While a financial report does not show opportunity cost, investors/owners can use the P&L and BS ratios to make informed decisions about a company's value, such as the expected rate of return and the relative risk of investing in each option in addition to its potential returns.

An opportunity cost would be to buy a piece of heavy equipment with an expected return on investment (ROI) of 5% or one with an ROI of 4%. Sunk costs are the non-refundable funds initially laid out to purchase the equipment.

The opportunity cost of holding the underperforming asset may rise to where the rational option is to sell and buy into a more promising investment.

Difference Between Risk and Opportunity Cost

Risk compares the actual performance against the projected performance of an investment, while opportunity cost compares the actual performance of one against the actual performance of another investment.

Opportunity costs should be considered when deciding between two risk profiles. Investment A is risky but has an ROI of 20%, and investment B is far less risky but has an ROI of 5%. If A's risks cannot be minimized, then the opportunity cost of going with option B is smarter.

Potential Owners' Return (POR)

POR = Owners' salaries + Net Profit Lost

How to minimize the risks for the most desirable option

One potential solution is a solid contract that clearly states how the remedies for non-performance far outweigh the opportunity for non-performing, and the pay-out must be easily enforceable through the Courts and large enough to deliver the projected ROI.

Operational risk management (ORM) is defined as a continual cyclic process which includes risk assessment, risk decision making, and implementation of risk controls, which results in acceptance, mitigation, or avoidance of risk.