Cross-company Production Platforms (PP)

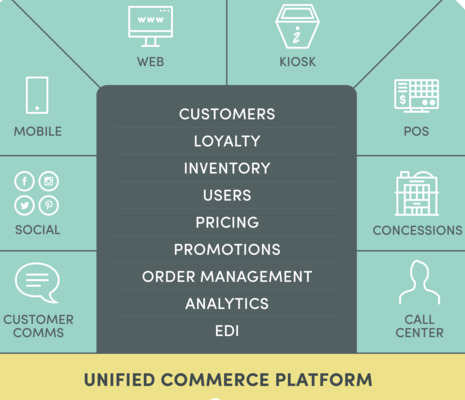

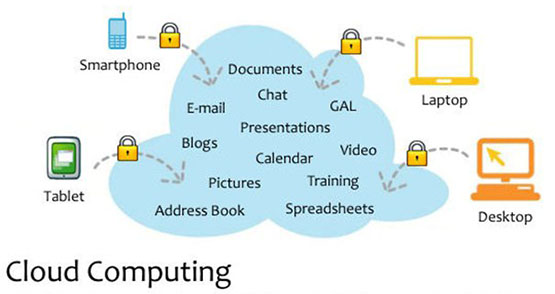

A computing platform or digital platform is the environment in which a piece of software is executed. It may be the operating system (OS), even a web browser and associated application programming interfaces, or other underlying software, as long as the program code is executed.

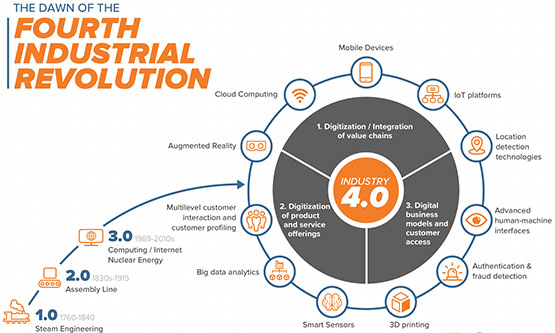

To keep up with the massive changes in 4IR, companies must transition away from today’s largely vertical company-owned assets model to horizontal cross-company PP.

The emerging platforms used in major value chains come in two categories:

The traditional model lacks the diversity of perspective and breadth of capabilities to meet the more unpredictable and customized expectations now being placed on companies.

When companies reach outside their supply chains to secure what they need, the process is often badly encumbered by traditional organizational boundaries, like too slow response time, etc.

4IR PP can help companies meet today’s demands of the market by:

1. blending digital and physical assets, and

2. bringing together multiple companies to satisfy those demands.

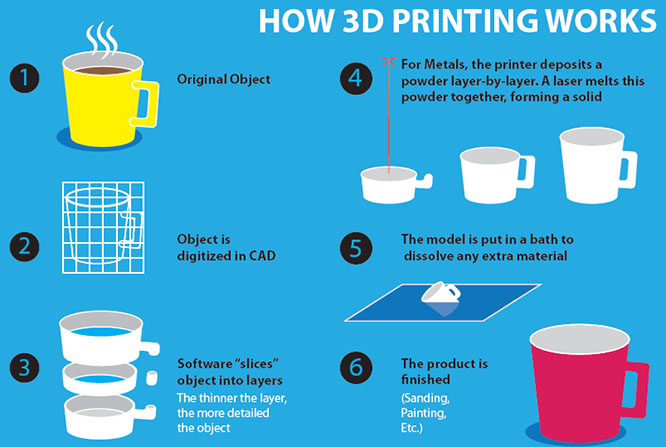

4IR PP help players across the value chain adapt to and prosper in the 4IR, using the power of digital technologies, like 3D printing, which allows companies meet the growing consumer demand for product personalization.

4IR PP’s that have already emerged across several supply chain functions are:

Plan: Blue Yonder, a machine learning cloud-based platform for predictive demand forecasting and inventory optimization, offers a flexible pay-as-you-go platform for companies seeking to leverage the power of AI/machine learning. Participating companies provide data for training the underlying algorithms across different product category, country, and channel dynamics. This training data helps fine-tune the underlying AI algorithm, to the benefit of all participants and their competitors in the network.

Make: Drishti is a company that leverages AI vision-based technology to capture and analyze human activity within factory walls to pinpoint optimization opportunities. As customers join their subscription-based platform, they provide valuable training data and use cases to fine-tune the underlying motion analytics engine, benefitting all participants.

Deliver: Flexe offers on-demand warehousing space to businesses. The cloud-based operations management interface allows warehouse owners and companies to list their available capacity on the platform and others to rent their excess warehousing space. This AirBnB approach to securing warehouse space provides a low risk, low cost option for retailers and brands to test new omni-channel delivery concepts, such as same day delivery pilots near critical areas, without building their own dedicated distribution centers.

Global logistics providers may offer 3D print farms, co-located across their respective delivery hubs, to serve high margin, personalization-based industries, such as the medical and business-to-business aftermarket.

Major shifts

The transition to 4IR PP will fundamentally change the way manufacturers will create value and serve customers. Some major shifts likely to emerge:

From owned assets to orchestration. Manufacturers could leverage capability platforms outside their facilities to create innovative products and experiences, contrary to just have efficiently operating large-scale assets. Managing large hierarchies has to give way to agile orchestration of smaller size firms.

From linear flows to value webs. Besides end users of products, consumers become active participants in the supply chain, from defining product concepts to serving as final delivery couriers. Thus, roles will become increasingly blurred between suppliers, manufacturer, distributer, and consumer.

From centralized to centerless. Management shifts from a key performance indicator (KPI)-driven, digital, central control & command to decentralized agile entrepreneurial teams that make local decisions.

From IRR to VCF. The traditional Internal Rate of Return-based corporate financing will shift more to a Venture Capital Finance approach of investing in stages, but without experimenting with new business and operating models.

Underlying fundamentals

As 4IR PP could easily fall victim to win/lose situations, monopolistic practices, unethical data use, etc.

3 fundamentals should be built in from the start:

Getting ahead of the platform curve

Technology is not the whole answer. 4IR PP will flourish only when all stakeholders recognize that collaboration and co-ownership offer a means to competitiveness and added value.

Building 4IR PP will help companies to:

For executives, the challenge is not predicting the exact type and timing of future 4IR PP in their sectors or across supply chain functions. Rather, it is learning how to integrate a platform mindset into their business model and supply chain.

As businesses take important steps toward the implementation of 4IR PP, policymakers can proactively promote their democratization across evolving production ecosystems.

Company actions to implement and scale up cross-company PP should complement country or region-level measures, as 4IR PP will be an increasingly essential driver of global economic growth.

The above is just a hint of what is to come once companies grasp the performance potential they can tap into by engaging in 4IR PP. Companies that fail to capitalize on these opportunities may soon perish.

Some platforms are internal to a company, and therefore closed. Others are open, such as Linux, the open-source operating system.

Platforms are a common feature of complex systems, whether economic or biological. The core building blocks are kept stable so that the other parts can evolve more rapidly by combining and recombining them and adding new ones:

Today the IT sector looks like a very flat inverted pyramid:

By lowering transaction costs, IT allows big chunks of the economy to reshape themselves and turn into what is called “stacks”, industry-wide ecosystems that will have large platforms at one end of their value chains and a wide variety of modes of production at the other, from start-ups to social enterprises and communities to user-generated content.

Stacking up

In Industry 4.0, companies have to become agile ecosystems, complete with start-ups and accelerators. Coca-Cola is launching accelerators in 9 cities. Such actions will change our perception of what a ‘corporation’ means.

The spread of platforms will force more and more employees to become founders or be employed by start-ups in a technological garden where a thousand flowers bloom, but only a few will bloom really big. Probably, many people will find it hard to get used to such a fast-moving world of work.

Antitrust authorities will need to be alert because platform operators, which are open quasi-monopolists, will have strong incentives to maintain their dominance. The most powerful of them, like Amazon, Facebook or Google, will amass huge amounts of information and become the central data banks for the knowledge economy.

Especially, governments have to consider what role they want to play in this new world. Currently they resemble a “vending machine” offering a limited set of choices, but they would function much better as a platform for a “thriving bazaar” of government services, offering basic building blocks that others can use.

This suggests that the state needs to limit what it does, but do it well. In a future digital world big business and big government may play similar roles, as platform managers and curators of ecosystems. Cities or even governments may offer services to other cities and countries in fields such as online identity and regulatory oversight.

Those who see the current entrepreneurial explosion as merely another dotcom bubble should think again. It appears to be more of a People Tsunami who are forced to be their own boss, using platforms to collaborate and stay alive.