SIX CAPITAL MODEL

Click image

1. Physical capital: Optimal distance from Shanghai

After the start of China's Reform and Opening policy in 1978, the "Middle Kingdom" grew most rapidly along its southeastern seaboard. The hinterland, despite a subsequent concerted western development campaign, tended to lag behind the fast risers.

In hindsight, the location of Hefei turned out to be optimal. It is sufficiently close to Shanghai to benefit from the dynamism of the so-called "Magic City" on the estuary of the Yangtze River, but far enough not to be weighed down by the juggernaut's complex politics and powerful bureaucracy.

2. Institutional capital: An elite university in an unlikely location

In most cases, China's top universities are based in top tier cities. Yet the prestigious University of Science and Technology of China (USTC), a public research and teaching institution known as "China's Caltech", moved to Hefei during the tumultuous Cultural Revolution.

It has become a veritable catalyst for the establishment or attraction of other valuable institutional capital in the form of cutting-edge national scientific and technological research institutions of significant scale and other powerful organizations.

3. Human capital: Free exchange of talent in different occupations

The accumulated institutional capital has helped to develop and attract top talent in areas such as science, technology, engineering and business to Hefei.

To start with, government officials are often hired from the above-mentioned cutting-edge educational institutions and, after assuming office, work closely with them. This endows them with specialized and localized knowledge, helping them to make smart economic decisions.

To increase motivation, the Hefei government has put in place a system of material and intangible incentives, including the promotion of those who have selected impactful projects and thus contributed to industrial development.

As a consequence, there is a strong positive correlation between hierarchical level and competence. Incidentally, the following feature of the new 'multipolar world' is intriguing: On average, the strong (and steadily increasing) competence of key government personnel in high-growth markets such as China and Russia is in sharp contrast with the comparatively very weak (and decreasing) expertise of elected top officials in most governments in the collective West.

The sophisticated institutions in Hefei also helped develop and attract top-notch talent in academia and business. Importantly, a "revolving talent door" implies that there is a constant and free exchange between smart people in different spheres, especially between the government, business and academia, reinforcing mutual learning processes.

As a result, government officials in Hefei oftentimes are veritable economic experts. Furthermore, industrial talent knows which levers to pull in the government to achieve desired results.

4. Intellectual capital: Smart strategies for industrial upgrading

In turn, the deep talent pool in Hefei has generated rich intellectual capital, including a steady stream of creative breakthroughs in basic and applied scientific research. At least equally important is the development of smart economic blueprints, structures, systems and processes by key strategic planners in government and business.

Building on the basic components of "New Structural Economics" (NSE), the strategy process tends to focus on identifying promising R&D projects and industries with high potential (including positive spillover effects). It aims at constantly upgrading the local industrial structure, leveraging both the latent factor endowment of the city and the energizing power of lofty aspirations, even when there are no latent factors and "leapfrogging" is necessary.

One key ingredient of such smart planning is the adoption of a holistic, systemic, and dynamic view with respect to the development of industry clusters and the respective vertically integrated supply chains in their entirety.

Hefei places a key emphasis on technological progress, achieved, among other things, by the government's support of basic research. The emerging interconnected ecosystems allow for strong spillover and snowballing effects, with new companies being attracted to existing clusters.

In a process of constant upgrading, there is a move towards activities that create increasingly higher value. Often, leaders encapsulate the gist of a strategy in highly memorable, metaphorical combinations (usually consisting of four Chinese characters), such as "changing lanes and overtaking" and the visionary development concept of "leading enterprises – big projects – industrial chain – industrial agglomeration – industrial base".

Importantly, while government officials have been changing, there has been remarkable continuity in strategic planning in Hefei.

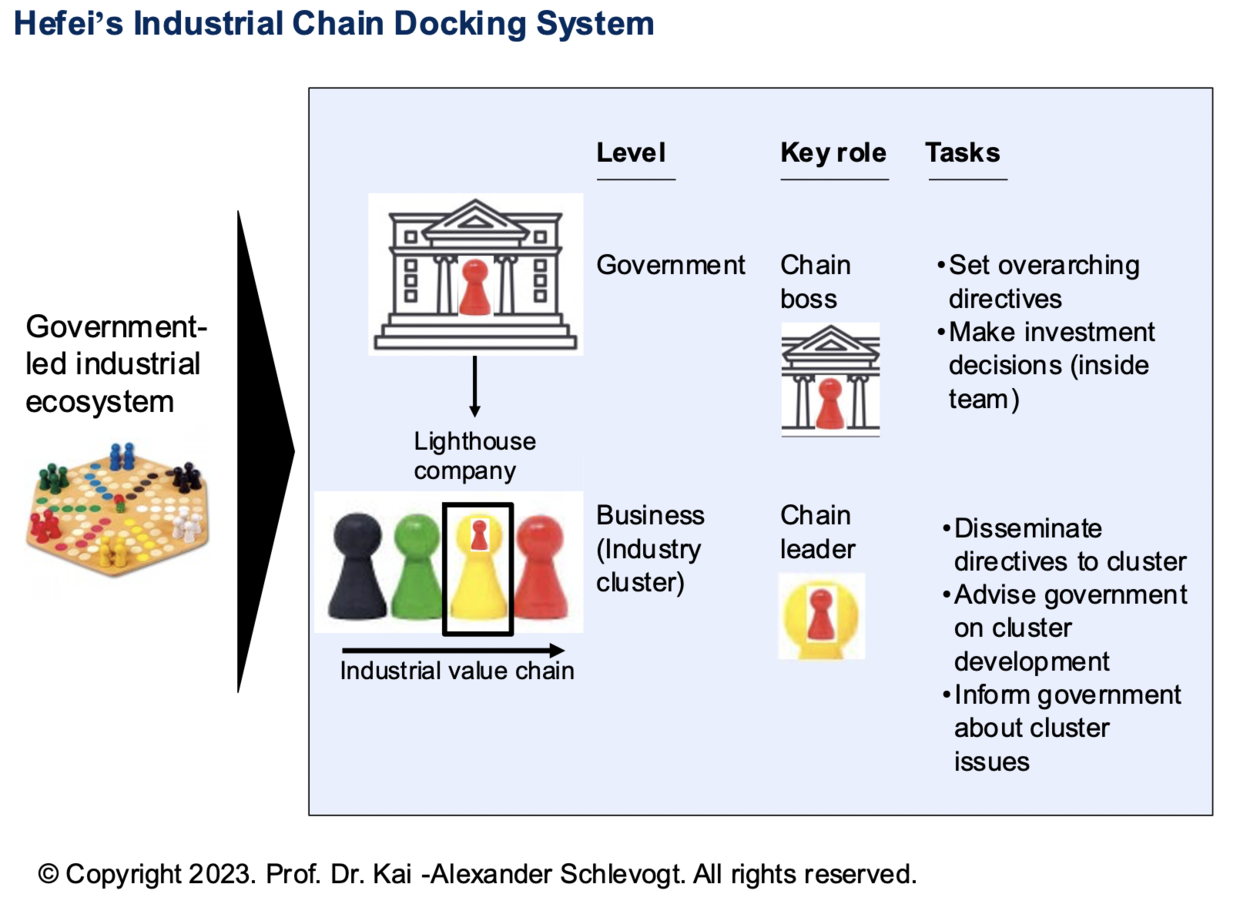

With respect to the organizational design of ecosystems, Hefei adopted an "industrial chain docking system" that relies on boundary-spanning human linchpins (see Figure 2).

In fact, this innovative arrangement, which is a veritable factory of invention and innovation, is the center piece of the Hefei Model.

Forming part of a "chain length system," there are 12 prioritized industry clusters, each of which is headed by a key government official, such as the mayor or the local Communist party chief.

He acts as a "chain boss," giving overarching directives to subordinate units. In particular, this key person communicates intensively with a lead company in a given cluster, called a "lighthouse company."

The government chooses a "chain leader" inside this company, docked to the "chain boss" and jointly recommending concrete strategies for growing the cluster (including state investments and the admission of new members).

The corporate chain leader, who leverages the collective wisdom of various stakeholders, also informs his "one stop shopping" government contact about burning issues inside the cluster, including the sourcing of critical inputs and occurrence of severe bottlenecks.

To achieve a parallel and balanced development of several industries at the same time and thus speed up economic development, this dual linchpin structure is used across all the 12 prioritized clusters:

5. Financial capital: Government officials acting as venture capitalists

Based on the interactively developed smart strategic blueprints, the city government in Hefei, aided by "investment consultants" from industry (who, among other things, advise the government and perform due diligence), assumes the role of a venture capitalist and strategic equity investor.

It acquires stakes in chosen companies and projects through various municipally-owned urban construction funds at multiple levels in the governmental hierarchy and, to reduce risk, actively engages in post-investment management.

Solving a veritable investment puzzle, the government in this manner develops missing cluster elements, such as upstream or downstream companies in the value chain or key resources, and constantly upgrades the city's economic structure as a result.

By taking well-considered risks and leading the way as an investor in pioneering firms operating in nascent industries, it also attracts other companies in the value chain of an emerging cluster.

Interestingly, the city government delays other projects at times, such as infrastructure investments, to upgrade its industrial structure. Apart from early, small investments in emerging technologies, helping their developers on the "first mile," the city made daring decisions, involving significant commitments of funds, oftentimes defying conventional wisdom and mainstream opinions in a countercyclical manner.

As a result of its tendency to place big and risky bets, sarcastic pundits labeled Hefei as China's true "gambling city" (instead of Macao).

In 2008, Hefei's Urban Construction Development Co Ltd., against all odds, decided to invest $5.2 billion in BOE Technology Group, which has since become one of the world's largest manufacturers of displays.

In 2022, well-informed and intelligent government officials in Hefei invested $700 million (56% of the total liquid assets of the city government at that time) in the near bankrupt electric vehicle producer NIO, which moved its Chinese headquarters and some of its manufacturing to the city as a consequence.

NIO achieved a dramatic recovery, currently supplying one third of China's luxury EVs. As a result of this risky bet, Hefei reaped a significant financial gain, amounting to 5.5 times its investment outlay.

Early on, the local government tends to design and implement smart exit strategies, too, selling stakes as soon as its investment mission has been accomplished. Instead of clinging onto profitable assets to fill the city's coffers with their financial proceeds, in this manner it allows the market to produce efficient outcomes as soon as key externalities (such the lack of investment in basic research) have been eliminated.

The success achieved in the form of high sales receipts endows the government with a "right to grow." In a process of "entrepreneurial bootstrapping," the city invests those funds in higher value-added activities, unleashing a virtuous circle of capital.

For example, the proceeds from the city's successful investment in the electrical vehicle industry have been re-invested to further develop the integrated circuit cluster.

In some countries, government officials who fear punishment tend to be afraid of acting like dynamic entrepreneurs and taking even well-considered risks. In contrast, it is noteworthy that the fault tolerance in the Hefei government has successively increased and reached comparatively high levels, enabling state funds to make bold and risky decisions.

For example, in 2022, the Municipal Seed Fund increased its fault tolerance rate to 50%. Being empowered by the highly motivating slogan "dare to make decisions and take responsibility," too, government officials in Hefei are given great strategic and operational latitude and freedom.

Such a determined use of the principle of subsidiarity on the ground, which leverages the power of local competence, knowledge, and dynamism, contrasts with the fake caricature of China spread by Western liberals, who routinely accuse the country as being authoritarian.

6. Social capital: High trust inside intricate networks

In connection with the other components of the "Six capital" model, the government of Hefei has been able to accumulate great amounts of social capital embedded in highly developed, boundary-spanning relational networks, but above all, deeply engrained entrepreneurship and trust from top to bottom and horizontally across the clusters.

Due to strong path dependencies and causal ambiguity, it is especially difficult for competitors to replicate this particular form of invisible capital.

In Hefei, a strong entrepreneurial spirit pervades all stakeholders in a state-of-the-art agglomeration of dynamic clusters. This agglomeration in effect functions as one entity, which could be entitled "Hefei Inc."

In addition, the high amount of trust in the intricate and robust networks facilitates the smooth flow of valuable information between government officials and other stakeholders, including industrialists and academics, in this highly diversified agglomeration.

This, in turn, allows for smooth decision making by players at all organizational levels, such as the party committee, city government and fund management. The smooth flow of information also implies that there is constant and timely feedback with respect to the decisions taken, allowing for quick adaptation and adjustment if needed.

As a consequence, a well-integrated "learning ecosystem" is emerging, which is led by "state entrepreneurs" and "state capitalists" who are veritable economic specialists and industry experts. The entire process of collaboration and sharing is captured by yet another memorable expression: "Up and down working together" for a common win-win.

In summary, the "Six capital model" of Hefei made it possible for a Chinese inland city with comparatively limited resources and low national visibility to become a key global player in a range of cutting-edge industries.

Quite remarkably, this "perfect" partnership model mainly hinges on intangible factors, which in China – due to the previously pervasive "hardware mindset" – have been neglected for a long time.

Given the city's successful government-led transformation, this ingenious and innovative development model might function as a lighthouse for the Chinese ship of state, which needs to navigate in stormy waters and amids governments in a quest for growth around the world.

Can this model lead us back to the original idea of Karl Marx, because the organization of the workplace, the factory, the office, the store, had never been transformed by the socialists nor communists in the 20th century.

This was left to a small group of people, the owners of the enterprise, the Board of Directors, whether private or government individuals, who made all the decisions, imposed the rules, and made off with a disproportionate part of the wealth that was being produced.

Therein lays the core of the problem!

It should be a nurturing community, run by a democratic collection of individuals caring for and acknowledging their dependence on one another.